The window replacement industry thrives on vague promises. Marketing materials overflow with terms like “energy-efficient” and “premium quality” without explaining what separates a $300 window from a $900 one. Homeowners face a frustrating choice: overpay for features they don’t need, or underinvest in performance that could transform their home’s comfort and operating costs for decades.

This analysis moves beyond isolated product comparisons to examine how windows function as integrated components within your home’s thermal envelope. Rather than accepting sales pitches at face value, you’ll gain the technical literacy to evaluate premium window and door solutions through engineering fundamentals, lifecycle economics, and independent verification methods.

The following sections progress from system-level performance impacts to material science, then to honest scenarios where standard windows deliver superior returns, before concluding with actionable tools to audit premium claims before contract signature. This framework protects against both unnecessary spending and the costly mistake of choosing inadequate performance for your climate and building type.

Premium Windows Decoded: Essential Insights

Premium windows alter whole-home energy dynamics by reducing HVAC equipment requirements and eliminating thermal weak points throughout the building envelope. Understanding the physics behind low-emissivity coatings, gas fill behavior, and thermal bridging reveals why certain materials justify cost premiums while others represent marketing inflation. However, climate zones, ownership timelines, and existing home conditions create scenarios where quality-standard windows outperform premium options on pure return-on-investment metrics. Total cost of ownership over three decades includes variables like replacement cycles, maintenance intervals, and insurance impacts that simplistic payback calculators ignore entirely.

How Premium Windows Alter Whole-Home Energy Performance

The conventional approach isolates window performance through U-factor and Solar Heat Gain Coefficient ratings. While these metrics matter, they obscure the cascading effects premium windows create throughout interconnected building systems. When engineers calculate heating and cooling loads, window performance directly influences equipment sizing decisions that carry multi-thousand-dollar implications.

Homes with superior window assemblies experience reduced peak load demands during extreme weather events. This allows HVAC contractors to specify smaller capacity systems without compromising comfort. Research demonstrates that 15-30% HVAC capacity reduction becomes achievable when premium windows minimize heat transfer at the building envelope’s weakest historical point.

The financial logic extends beyond energy bills. A smaller furnace or air conditioner costs less to purchase and install. The equipment runs more efficiently within its optimal performance range rather than cycling constantly to compensate for thermal losses through substandard windows. This creates what engineers call the thermal envelope multiplication effect—premium windows reduce stress on insulation, air sealing, and structural thermal breaks simultaneously.

Thermal imaging reveals these dynamics visually. Infrared cameras capture radiant heat escaping through standard window assemblies as bright orange and red signatures against cooler wall sections. Premium windows appear nearly identical in temperature to surrounding insulated walls, demonstrating how advanced glazing systems eliminate the thermal bridging that standard products accept as inevitable.

Real-world data validates these principles beyond laboratory testing.

Chicago Home Energy Performance Analysis

A 2,000 square foot Chicago home demonstrated $422 annual savings with an 8.2-year payback period after upgrading to premium windows. The improved thermal envelope allowed downsizing of HVAC equipment, creating installation cost offsets that accelerated ROI. Source: Guardian Home Energy Analysis

The comfort economics deserve equal consideration. Standard windows create cold zones during winter where radiant heat loss makes spaces near glazing uncomfortable despite adequate air temperature. Homeowners compensate by raising thermostats or avoiding rooms entirely. Premium windows with warm-edge spacers and multiple low-E coatings eliminate these microclimates, expanding usable living space without additional square footage.

| Home System | Standard Windows | Premium Windows |

|---|---|---|

| Heat Loss/Gain | 25-30% of energy use | 10-15% of energy use |

| HVAC Runtime | Baseline | Reduced 20-40% |

| Comfort Zones | Temperature variations | Consistent throughout |

Zone heating needs decline when temperature consistency improves. Families stop supplementing central systems with space heaters in problem areas. This behavioral shift compounds energy savings beyond what simple heat transfer calculations predict, demonstrating why system-level analysis reveals value that component-focused comparisons miss entirely.

The Material Engineering That Creates Measurable Performance Gaps

Marketing claims about “advanced materials” collapse into meaningless jargon without understanding the physics that generate superior thermal performance. The difference between a window that pays for itself and one that represents wasted capital lies in specific engineering choices governing heat transfer mechanisms at molecular and structural levels.

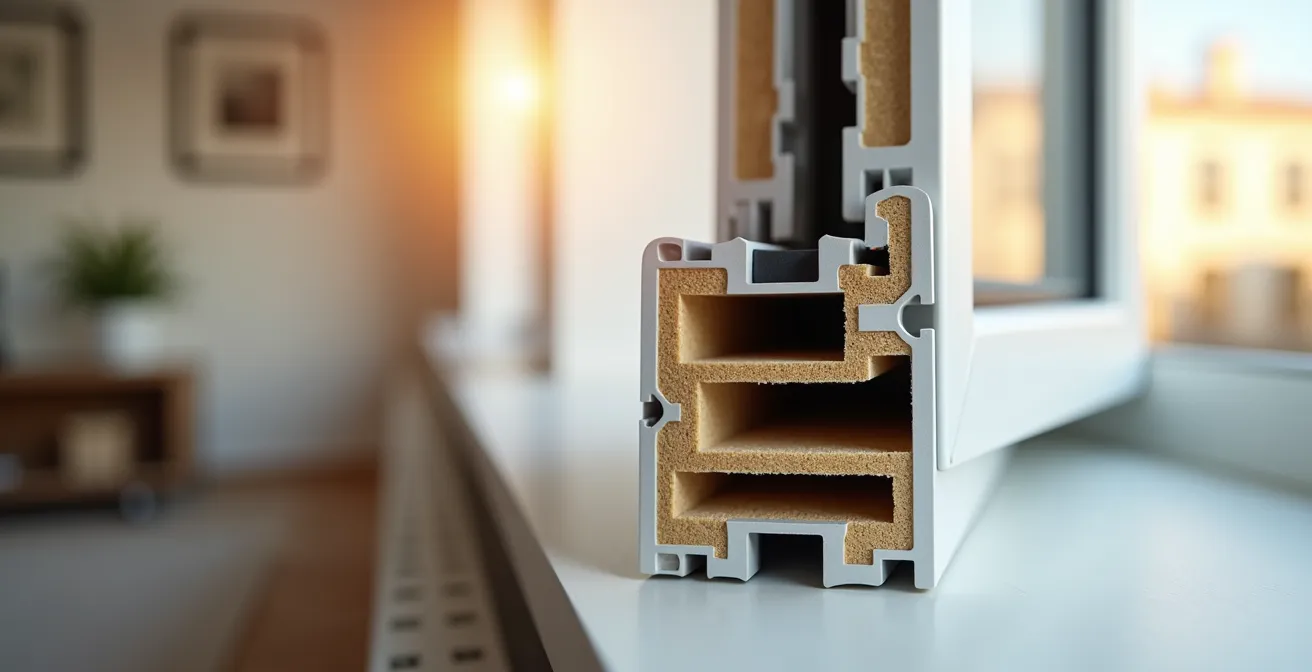

Thermal bridging occurs when conductive materials create pathways for heat to bypass insulating barriers. Aluminum spacers between glass panes conduct thermal energy approximately 1,000 times more effectively than composite alternatives. Thermal imaging makes this invisible problem visible—standard windows with metal spacers show bright perimeter signatures where heat escapes around glass edges, even when the center glazing performs well.

Warm-edge spacer technology substitutes materials with thermal conductivity coefficients below 0.3 W/mK. This seemingly minor specification change eliminates condensation risk at glass edges while reducing whole-window U-factors by 10-15%. The performance gap compounds in extreme climates where temperature differentials stress conventional spacer designs.

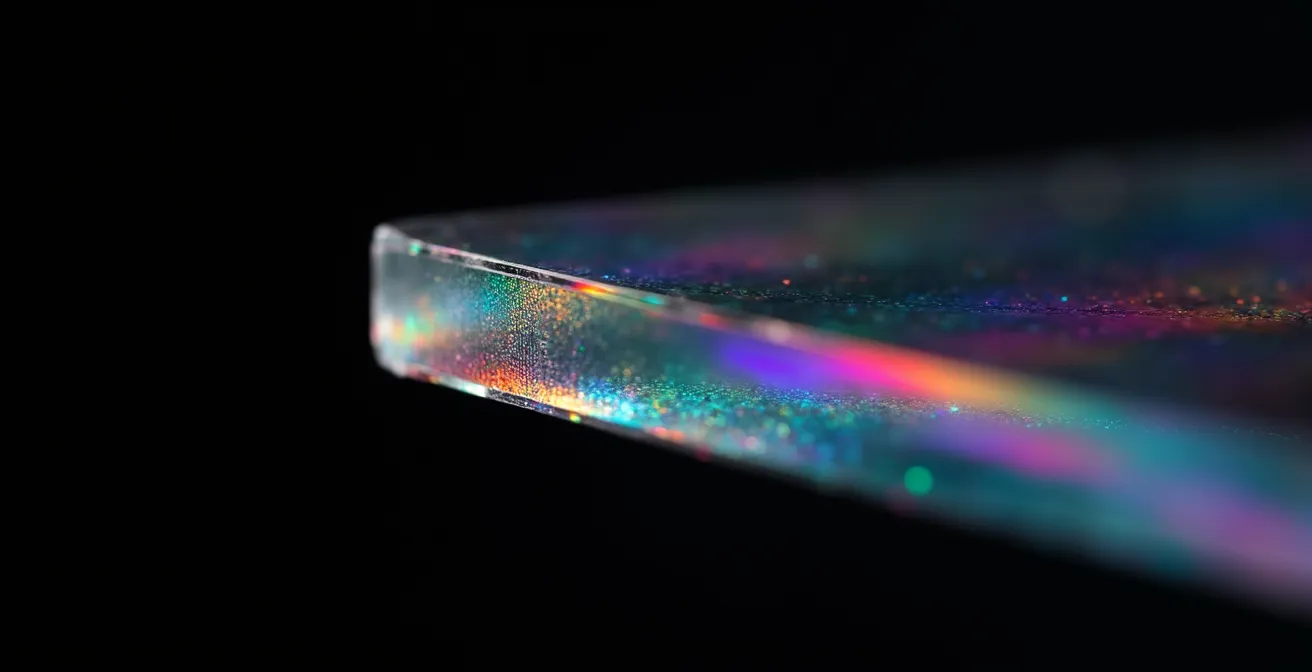

Low-emissivity coating technology represents another engineering breakthrough obscured by simplified marketing. Microscopic metallic layers—measured in angstroms—reflect infrared radiation while transmitting visible light. This selective transmission allows natural daylighting while blocking radiant heat transfer that accounts for the majority of thermal exchange through glazing.

Multiple low-E coatings on different glass surfaces within an insulated glazing unit create wavelength-specific performance tuning. Winter-climate optimized windows use coatings that retain indoor heat while maximizing solar heat gain. Cooling-dominated climates require different coating placement that blocks solar radiation while allowing heat rejection. Premium manufacturers offer climate-specific configurations; budget products apply one-size-fits-all approaches that compromise performance.

Gas fills between glass panes further reduce convective heat transfer. Argon and krypton possess lower thermal conductivity than air due to their molecular density and atomic structure. Research confirms that fiberglass frame materials achieve 0.04 W/mK conductivity ratings, outperforming vinyl and aluminum alternatives by substantial margins in temperature differential scenarios.

Frame material selection carries implications beyond conductivity coefficients. Fiberglass maintains dimensional stability across temperature extremes that cause vinyl to expand and contract, compromising seal integrity over time. Wood offers excellent thermal performance but demands maintenance that many homeowners neglect. Each material involves engineering trade-offs between thermal efficiency, structural requirements, and lifecycle durability.

The performance degradation curve matters as much as initial specifications. Low-E coating durability varies by deposition method—sputtered coatings demonstrate superior longevity compared to pyrolytic alternatives. Gas fills gradually escape through perimeter seals, with argon retention rates declining to 80% after 20 years in standard assemblies. Premium products specify higher-quality seals and gas concentrations that maintain performance throughout longer service lives.

When Standard Windows Deliver Superior Return on Investment

The window industry’s economic incentive encourages universal premium recommendations regardless of actual need. However, specific building conditions, climate factors, and ownership scenarios exist where quality-standard windows generate better financial outcomes than premium alternatives. Identifying these situations requires honest analysis that sales-oriented content systematically avoids.

Climate zone analysis reveals the first decision point. Department of Energy mapping divides North America into zones based on heating and cooling degree days. Mild climates—particularly Zone 3 covering coastal California, the Southeast, and southern Texas—experience temperature differentials insufficient to justify premium window costs within typical 7-10 year ownership periods that characterize American housing markets.

The mathematics demonstrate this clearly. A home in San Diego with minimal heating requirements and moderate cooling needs might save $150 annually with premium windows compared to quality-standard alternatives. If the premium option costs $8,000 more for whole-house replacement, the simple payback period exceeds 50 years before considering the time value of money. That capital allocated to additional insulation or HVAC efficiency upgrades would generate superior returns.

Investment property ownership changes the calculation entirely. Rental properties and house-flipping projects prioritize different metrics than owner-occupied residences. Tenants don’t pay replacement costs, reducing their incentive to maintain products carefully. Meanwhile, investors require faster payback periods—typically 3-5 years—that premium window energy savings rarely achieve even in harsh climates.

For these scenarios, quality-standard windows with robust warranties and proven durability profiles deliver better risk-adjusted returns. The reduced capital outlay preserves cash flow while adequate thermal performance prevents tenant complaints. Many property investors report that warranty coverage and replacement simplicity matter more than marginal efficiency improvements.

The diminishing returns threshold appears when homes contain more pressing envelope deficiencies. Premium windows installed in a house with inadequate attic insulation, significant air leakage, or absent wall insulation represent misallocated capital. The building science principle of balanced envelope improvement suggests addressing the worst-performing components first rather than over-investing in any single element.

A blower door test revealing 15 air changes per hour at 50 Pascals indicates that air sealing should precede window upgrades. Similarly, attic insulation below R-30 in cold climates delivers better cost-per-BTU savings than any window upgrade. Premium windows in an otherwise-poor envelope create an imbalanced system where expensive components cannot perform to their potential due to surrounding deficiencies.

Short-term ownership scenarios present another clear case for standard products. Break-even analysis demonstrates that premium windows require 12-18 years to recoup their cost premium through energy savings alone in most climates. Homeowners planning to relocate within 5-7 years invest capital they’ll never recover, even accounting for potential resale value increases that remain difficult to quantify and capture.

Market research on home values suggests buyers rarely pay dollar-for-dollar premiums for energy efficiency upgrades unless utility costs in the region create obvious pain points. In moderate climates with low energy prices, premium windows function as amenity features rather than financially justified improvements, making standard products the rational economic choice for near-term sellers.

Calculating True Ownership Costs Over Three Decades

Simplistic return-on-investment calculators dominate online window advice, focusing exclusively on energy savings and occasional resale value mentions. This narrow framing ignores the comprehensive total cost of ownership model that reveals hidden expenses and benefits accumulating across realistic service life expectations. A proper 30-year analysis includes replacement cycles, maintenance intervals, failure rates, insurance impacts, and even monetized comfort values.

The replacement cycle reality starts with acknowledging that standard windows average 15-20 year lifespans while premium products commonly reach 25-35 years before requiring replacement. This difference sounds modest until you factor inflation and installation disruption costs. A homeowner installing standard windows in 2025 faces another full replacement around 2040-2045, with labor and material costs inflated by 30-40% based on historical construction cost trends.

Premium windows installed today likely serve until 2050-2060, potentially avoiding an entire replacement cycle during the homeowner’s occupancy. The avoided future cost—discounted to present value—often exceeds the initial premium paid, especially when you account for the installation disruption, furniture moving, and potential interior damage that accompanies window replacement projects.

Maintenance cost differentials compound over time. Premium windows typically require professional service every 10 years at $200-400 per visit for seal inspection, hardware lubrication, and weatherstripping replacement. Standard products need more frequent attention—every 5-7 years—with higher failure rates requiring emergency repairs or premature component replacement.

Hardware quality particularly affects long-term costs. Budget window operators and locks fail after 7-10 years of normal use, requiring replacement parts that may no longer be manufactured. Premium brands maintain parts inventory for 30+ years and design mechanisms with serviceability in mind. The $75-150 saved per window initially becomes $300-500 spent later when standard hardware fails and requires professional repair.

Insurance implications rarely appear in window decision-making despite their financial significance. Storm-prone regions including coastal areas and tornado zones offer premium reductions of 5-15% for impact-rated windows that meet specific wind pressure and debris impact standards. On a $2,000 annual homeowner’s policy, a 10% reduction saves $200 yearly—$6,000 over 30 years before compounding.

Premium windows in these markets often include impact-resistance as standard features, while standard products require expensive laminated glass upgrades to achieve equivalent protection. The insurance reduction combined with avoided storm damage creates a compelling financial case independent of energy savings, particularly in regions where hurricane or hail damage represents genuine risk rather than remote possibility.

Comfort value monetization challenges conventional ROI thinking by attempting to quantify quality-of-life improvements. While inherently subjective, methods exist to estimate dollar values for draft elimination, noise reduction, and consistent room temperatures. One approach asks what monthly rent premium tenants would pay for superior comfort, then capitalizes that value over ownership duration.

Research from multi-family housing suggests that units with premium windows command $50-100 monthly rent premiums in competitive markets where tenants pay utilities directly. Capitalizing this at a 5% rate yields $12,000-24,000 in present value terms. Owner-occupants enjoy this comfort benefit without rental income, but the revealed preference of rental market behavior suggests real economic value beyond mere subjective preference.

HVAC equipment longevity represents another hidden variable in total cost calculations. Reduced cycling from improved envelope performance extends compressor and heat exchanger service life measurably. Industry data indicates that systems experiencing 20-40% runtime reduction through envelope improvements last 3-5 years longer on average, deferring $4,000-8,000 in replacement costs per system.

Verifying Premium Specifications Before Contract Signature

Understanding what premium windows should deliver and calculating whether they make financial sense becomes meaningless without tools to verify that quoted products genuinely provide advertised performance. The gap between marketing claims and installed reality costs homeowners thousands annually through efficiency shortfalls, warranty disputes, and premature failures. Effective verification requires specific steps before making final payment.

NFRC certification labels provide the foundation for objective performance verification. The National Fenestration Rating Council operates independent testing that generates U-factor, Solar Heat Gain Coefficient, Visible Transmittance, and Air Leakage ratings for specific window configurations. Every premium window should display an NFRC label containing a unique certification number linking to the online database.

Verification involves photographing the label and confirming the certification number appears in the NFRC directory at nfrc.org. The database listing should match the manufacturer, product line, and configuration specified in your contract. Discrepancies indicate either counterfeit labels or product substitution—both legitimate grounds to halt installation and demand correction before proceeding.

Certification numbers also reveal whether the manufacturer tested the specific configuration you’re purchasing or a similar model. NFRC allows limited extrapolation from tested sizes and options, but significant deviations require separate testing. A 36″x48″ double-hung window performs differently than a 72″x60″ picture window in the same product line. Ensure the tested configuration reasonably represents what you’re buying.

Installer credential validation protects against installation defects that compromise premium product performance. AAMA—the American Architectural Manufacturers Association—offers installer certification programs that verify technical competency through testing and continuing education. Premium window manufacturers often require specific installation training before authorizing warranty coverage, making installer credentials a contractual issue rather than mere quality preference.

Request documentation proving installer certification before contract signature. Verify credentials directly with the certifying organization rather than accepting copies that might be outdated or fraudulent. Many manufacturers maintain online databases of authorized installers where you can confirm current status. Installation by uncertified contractors often voids warranties entirely, creating expensive liability if performance or durability problems emerge later.

Contract language should specify exact performance guarantees with independently verifiable metrics. Rather than accepting vague promises about “energy efficiency,” demand specific U-factor, SHGC, and air infiltration commitments matching NFRC-tested values. Include financial remedies if post-installation testing reveals non-compliance—typically requiring the contractor to replace windows at their expense or reduce contract price proportional to the performance shortfall.

Performance testing tools enable verification after installation but before final payment. Thermal imaging cameras—available as smartphone attachments for under $300—reveal thermal bridging, air leakage, and installation defects invisible to visual inspection. Schedule imaging during cold weather when indoor-outdoor temperature differentials exceed 30°F for maximum diagnostic clarity.

Blower door testing provides quantitative air leakage measurement before and after window replacement. While this requires hiring a certified energy auditor for $300-500, the investment protects against poor installation that compromises the entire project’s value. Air leakage reduction should be measurable and substantial—typically 15-25% improvement for whole-house replacement in homes without other major envelope deficiencies.

Condensation resistance verification matters particularly in cold climates and high-humidity environments. Premium windows should resist condensation formation even during extreme weather events. Testing involves monitoring glass surface temperatures with infrared thermometers during the coldest periods of the first winter post-installation. Interior glass surface temperatures remaining above dew point temperature—calculable using psychrometric charts with indoor humidity levels—indicate proper performance.

Warranty documentation deserves careful review before purchase rather than cursory acknowledgment at closing. Premium window warranties typically cover glass seal failure, hardware defects, and frame degradation for 20-30 years, but exclusions and transferability terms vary dramatically. Warranties that require annual professional maintenance, exclude specific failure modes, or become void upon home sale deliver less value than their headline duration suggests.

Key Takeaways

- Premium windows reduce HVAC equipment sizing requirements by 15-30%, creating installation cost offsets that accelerate payback beyond energy savings alone.

- Material engineering specifics like warm-edge spacers and frame conductivity ratings determine real performance gaps that marketing terms obscure.

- Mild climates, investment properties, and homes with major envelope deficiencies often see superior ROI from quality-standard windows despite premium benefits.

- Total 30-year ownership costs include replacement cycles, insurance impacts, and HVAC longevity that simplistic calculators ignore completely.

- NFRC label verification, installer credentials, and independent performance testing protect against premium pricing for standard performance delivery.

Conclusion: From Product Selection to System Optimization

The premium versus standard window decision transcends simple product comparison once you understand the interconnected nature of building performance. Windows function as integrated components within thermal envelopes, not isolated products evaluated through specification sheets alone. This system-level perspective reveals both the hidden value premium windows create through cascading efficiency improvements and the scenarios where their benefits fail to justify cost premiums.

Material engineering fundamentals provide the technical literacy to evaluate marketing claims critically. Understanding thermal bridging physics, low-E coating technology, and frame conductivity coefficients transforms vague promises into measurable, verifiable specifications. This knowledge empowers informed decisions based on engineering reality rather than sales pressure or brand reputation alone.

Honest acknowledgment that standard windows sometimes deliver superior returns builds the credibility necessary for major investment decisions. Climate zones, ownership timelines, and existing home conditions create legitimate scenarios where premium products represent capital misallocation. Decision frameworks based on these contextual factors protect against both overspending on unnecessary performance and underinvesting in genuinely valuable upgrades.

Total cost of ownership modeling expands financial analysis beyond energy savings to encompass replacement cycles, maintenance intervals, insurance impacts, and comfort monetization. This comprehensive approach reveals long-term value that short-term payback calculations systematically underestimate while also exposing hidden costs that erode initial price advantages.

Verification methodology transforms passive consumers into active auditors capable of ensuring premium specifications translate to premium performance. NFRC certification confirmation, installer credential validation, and independent testing create accountability mechanisms protecting thousands of dollars in investment against substandard delivery.

For those ready to implement these principles, exploring comprehensive PVC and aluminium joinery options provides practical next steps. Beyond window selection, integrated home improvements create compounding value—homeowners optimizing their complete property envelope might also explore landscaping solutions that enhance both energy performance and property value simultaneously.

The investment in premium windows ultimately depends on matching specific products to individual circumstances through engineering analysis rather than one-size-fits-all recommendations. This article’s framework equips you to make that determination confidently, protected by verification tools and realistic cost modeling that separate genuine value from marketing inflation.

Frequently Asked Questions on Premium Windows

How do premium windows actually reduce HVAC equipment costs?

Premium windows minimize peak heating and cooling loads by reducing heat transfer during extreme weather. This allows HVAC engineers to specify smaller capacity systems—typically 15-30% reduction—that cost less to purchase and install while operating more efficiently within optimal performance ranges rather than cycling constantly to compensate for thermal losses.

What’s the difference between argon and krypton gas fills?

Both gases reduce convective heat transfer between glass panes better than air due to their molecular density. Krypton outperforms argon in thermal resistance but costs significantly more. Manufacturers typically use krypton in narrow glazing cavities (less than 0.5 inches) where its smaller molecular size provides maximum benefit, while argon serves wider cavities cost-effectively.

Should I factor HVAC equipment longevity into my decision?

Yes, premium windows reduce HVAC cycling by 20-40%, potentially extending equipment life by 3-5 years, worth $1,000-3,000 in deferred replacement costs. Reduced runtime decreases wear on compressors, heat exchangers, and motors while maintaining more consistent temperatures that prevent thermal stress damage to system components.

Do premium windows really affect home insurance rates?

In storm-prone regions including coastal areas and tornado zones, impact-rated windows meeting specific wind pressure and debris impact standards can reduce premiums by 5-15%. This creates $150-300 annual savings on typical policies that compound to thousands over decades while also protecting against expensive storm damage and emergency repairs.